Almost 70% of Americans think the housing market is heading for a crash in the next three years. With all the talk in the media lately about shifts in the housing market, it makes sense why so many people feel this way. But there’s good news. Current data shows today’s housing market is nothing like it was before the housing crash in 2008.

Mortgage Standards are Much Stricter Today

Years ago, during the housing crisis, it was much easier to get a mortgage loan than it is today. Banks lowered lending standards and made it easy for just about anyone to qualify for a home loan or refinance an existing one.

The lending institutions took on a much greater risk in both the person and the mortgage products offered. That led to more defaults, foreclosures, and falling prices. Things are much different today. Homebuyers face much higher standards from mortgage companies.

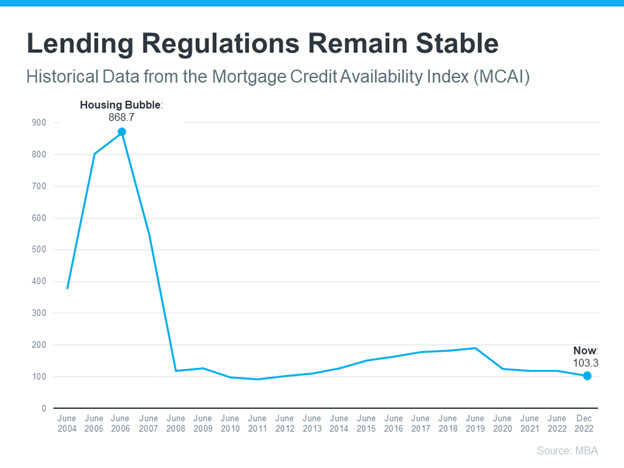

The graph below shows data from the Mortgage Bankers Association. In this graph, the higher the number, the easier it is to get a mortgage. The lower the number, the harder it is.

This graph also shows how different things are today compared to the spike in credit availability leading up to the crash. Tighter lending standards have helped prevent a situation that could lead to a wave of foreclosures like the last time.

Foreclosure Volume Has Declined Since 2008

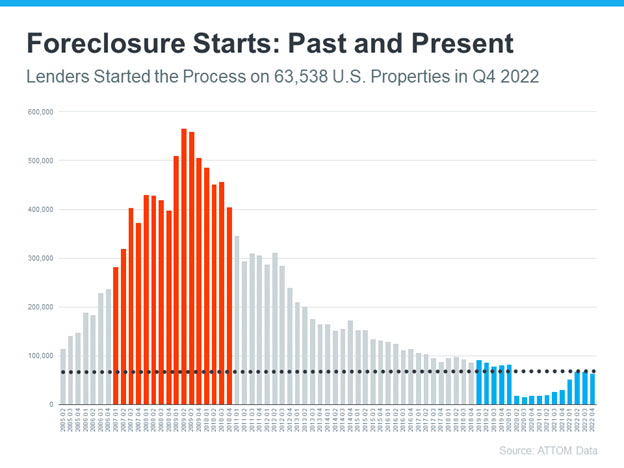

Another difference is the number of homeowners that were facing foreclosure when the housing bubble burst. Foreclosure activity has been lower since the crash in 2008, largely because buyers today are more qualified and less likely to default on their loans. The graph below uses data from ATTOM to show the difference between 2008 and 2022:

Most experts don’t expect foreclosures to go up drastically like they did following the crash in 2008. Bill McBride, Founder of Calculated Risk, explains the impact of increasing foreclosures on home prices years ago and how it’s unlikely to happen again.

Most experts don’t expect foreclosures to go up drastically like they did following the crash in 2008. Bill McBride, Founder of Calculated Risk, explains the impact of increasing foreclosures on home prices years ago and how it’s unlikely to happen again.

He said, “The bottom line is there will be an increase in foreclosures over the next year (from record level lows), but there will not be a huge wave of distressed sales as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.”

Limited Supply of Homes for Sale Today

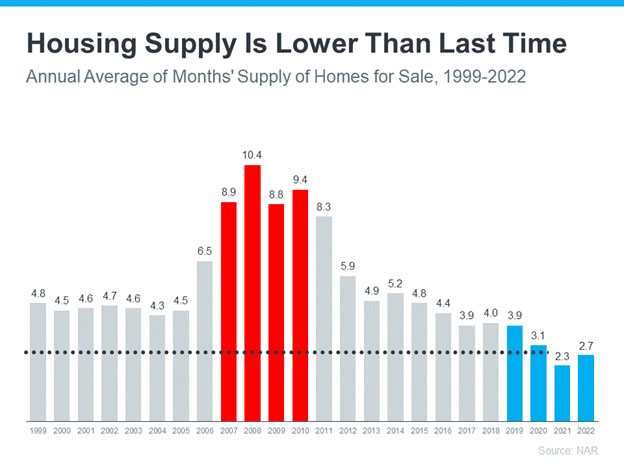

There were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), and that caused prices to fall dramatically. Supply has increased since the start of this year, but there’s still a shortage of inventory available overall, primarily due to years of underbuilding homes.

The graph below uses data from the National Association of Realtors to show how the months’ supply of homes available comparing 1999 to 2022. Today, unsold inventory sits at just 2.7 months’ supply at the current sales pace. This is significantly lower than the last time. There just isn’t enough inventory on the market for home prices to crash like they did last time, even though some overheated markets may experience slight declines.

If recent headlines have you worried that we are heading for another housing crash, the data above should help ease the fears. Expert insights and the most current data clearly show that today’s market is nothing like it was in 2008.

Downers Grove Real Estate Company

If you are looking to buy or sell a home, contact a real estate agent at Wenzel Select Properties today! Call 630-430-4790. Wenzel Select Properties is conveniently located in Downers Grove, Illinois, just 22 miles west of Chicago.