When you are looking to buy a house, condo or townhome, property taxes can make a significant difference in your monthly payment. Do you know how much property taxes are in your state or county?

When applying for a mortgage, you’ll see P&I (Principal and Interest) or PITI (Principal, Interest, Taxes, and Insurance). It will depend on how you’re including your taxes in your mortgage payment.

P&I are parts of your monthly mortgage payment that go toward paying off the loan you borrow. PITI is an important factor to calculate when you want to determine exactly what the cost of your new home will be.

What are Property Taxes?

Property taxes are a municipal tax levied by counties, cities, or special tax districts on most types of real estate – including homes, businesses, and parcels of land. The amount of property tax owed depends on the appraised fair market value of the property, as determined by the property tax assessor.

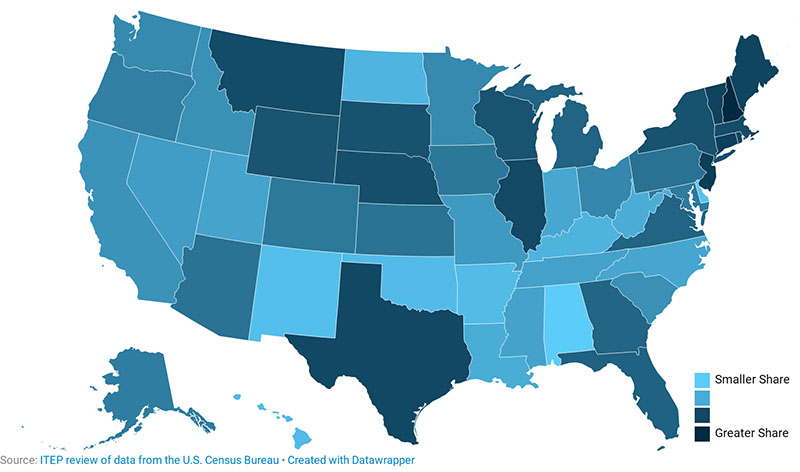

Sadly, in 2019 the state of Illinois will have the second-highest property taxes in the country. The statewide average effective tax rate is 2.32%, nearly double the national average.

Part of the reason for the high property taxes is that there are over 8,000 different taxing authorities in Illinois. Property taxes in Illinois support city governments, county governments, and school districts, along with a vast number of other local services and projects. Among the types of taxing districts that may appear on your property tax bill in Illinois are fire protection districts, sanitary districts, park districts, and even mosquito abatement districts.

How Illinois Counties Property Taxes Compare

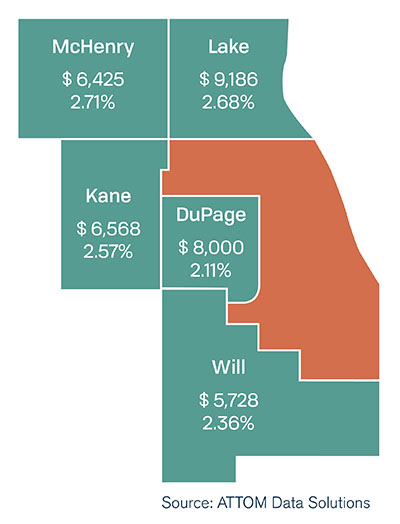

The image to the right shows property taxes average as much as $9,186 in Chicago collar counties. The average property tax bill, average property tax rate as a percentage of home value in 2018.

The image to the right shows property taxes average as much as $9,186 in Chicago collar counties. The average property tax bill, average property tax rate as a percentage of home value in 2018.

Cook County: Cook County is the largest county in Illinois and home to more than 40% of the state’s residents. Property tax rates in Cook County are actually lower than the state average, with an average rate of 2.14% in the county. The state average is 2.32%.

While Cook County’s assessment level of 10% for residential property is lower than the level in the rest of the state (33.33%), this difference is more or less wiped out by the state equalization factor, which was 2.8032 for the year 2016. That means assessed values as initially calculated are multiplied by 2.8032 to reach the assessed values to which taxes are applied.

Taxpayers in Chicago actually pay rates slightly lower than those in many surrounding cities. Over half of the revenue generated by Chicago property taxes goes to the Board of Education. About 18% of the tax revenue goes to the city itself and just over 8% goes to the county. In total the average Chicago homeowner pays about $3,538 annually in property taxes, compared to a Cook County average of $4,696.

DuPage County: A typical homeowner in DuPage County pays $6,375 each year in property taxes. That is the second-highest in the state but it is reflective of high home values in the state. The average home in DuPage County is worth more than $280,000, highest of any Illinois county. In fact, rates in DuPage County are about average for the state, with an average effective rate of 2.25%.

Lake County: If you are looking for low property taxes in Illinois, Lake County may not be the best choice. The county, which sits to the north of Chicago, has an average effective property tax rate of over 2.84%. This is the fifth-highest rate in the state. However, in absolute terms, Lake County homeowners pay more than anyone else in the state. The average homeowner in Lake County pays $6,997 in property taxes annually.

Will County: Will County sits to the south of DuPage and Cook counties and is home to the fourth-largest city in the state, Joliet. Property taxes in Will County are well above both the state and national averages. The average effective property tax rate in the county is 2.67%, more than double the national average. That means that if you own a $200,000 home in Will County, you can expect to pay more than $5,000 a year in property taxes.

Kane County: The fifth-most populous county in Illinois, Kane County also has some of the highest property taxes. The typical Kane County homeowner pays $5,865 annually in property taxes. While that’s $1,800 more than the state average, it is also less than neighboring DuPage County, where the average payment is more than $6,000 annually.

McHenry County: McHenry County has a below-average effective property tax rate in the state of Illinois. The average rate in the county is 2.03%. The largest recipient of funds from county property taxes are local schools, with school districts receiving over half of all revenue. Cities are the second-largest recipient.

SOURCE: smartasset

Property Tax Exemptions in Illinois

There are exemptions that can reduce your assessed value in Illinois. The most significant exemption is the General Homestead Exemption. It is available to homeowners living in their principal residence. The General Homestead Exemption is equal to a $7,000 reduction in assessed value in Cook County and $6,000 in all other counties.

Another important exemption is the Senior Citizens Homestead Exemption. This exemption is available to homeowners who are 65 years or older and can be applied to their primary residence only. It is equal to a $5,000 reduction in assessed value.

Bottom Line About Property Taxes

Depending on where you live, property taxes can have a big impact on your monthly payment. To make sure your estimated taxes will fall within your desired budget. Contact a Real Estate Broker at Wenzel Select Properties to see how an area you choose can make a difference in your overall costs when buying a home.