If you’re looking to buy a home, chances are you’ve got mortgage rates on your mind. For many prospective homebuyers, securing a mortgage is a pivotal step in the journey to homeownership. As mortgage rates fluctuate in response to market conditions, keeping track of these trends is essential for making informed decisions about when to lock in a mortgage rate. Fortunately, with the guidance of a trusted realtor at Wenzel Select Properties, navigating mortgage rate trends can be simplified, empowering homebuyers to secure the best possible financing options for their dream home.

Current Mortgage Rates

Mortgage rates have been volatile. They are affected by the economy, the job market, the current inflation rate, decisions made by the Federal Reserve, and more. Lately, all those factors have come into play, and it’s caused the volatility we’ve seen.

Odeta Kushi, Deputy Chief Economist at First American said, “Ongoing inflation deceleration, a slowing economy, and even geopolitical uncertainty can contribute to lower mortgage rates. On the other hand, data that signals upside risk to inflation may result in higher rates.”

Professionals Can Guide You with Rates

You could research decisions made by the Federal Reserve, the inflation rate, and more to understand how they impact mortgage rates, but that would be a lot of work. One of the simplest and most effective ways to keep track of mortgage rate trends is by staying informed through reliable sources of financial news and market analysis. Websites such as Bloomberg, FOX Business, CNBC, and Mortgage News Daily provide up-to-date information on mortgage rates, economic indicators, and forecasts, helping homebuyers understand the factors influencing mortgage rate movements.

Additionally, leveraging online tools and resources can streamline the process of monitoring mortgage rate trends. Websites like Bankrate and Freddie Mac offer mortgage rate trackers, historical data, and interactive charts that allow homebuyers to visualize trends over time and compare rates from different lenders. By regularly checking these platforms, homebuyers can gain valuable insights into the direction of mortgage rates and identify opportune moments to lock in a favorable rate.

Also, consulting with a knowledgeable realtor at Wenzel Select Properties can provide invaluable guidance and expertise throughout the home-buying process, including navigating mortgage rate trends. Team Wenzel coaches people through market conditions all the time. They’ll focus on giving you a quick summary of any broader trends up or down, what experts say lies ahead, and how all of that impacts you. Our team of experienced real estate professionals understands the local market dynamics, lender options, and financing strategies, ensuring that homebuyers receive personalized advice tailored to their unique needs and preferences.

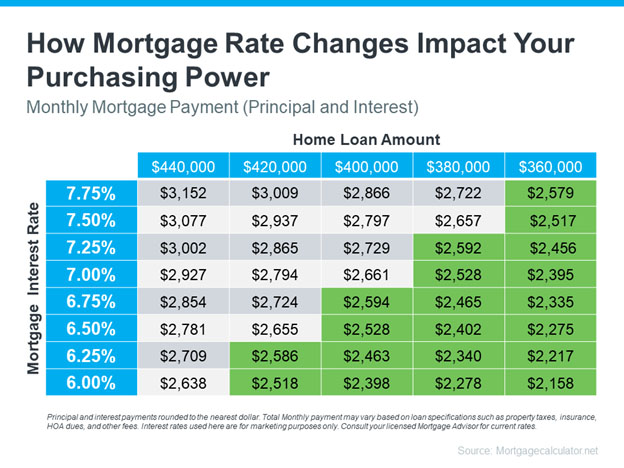

The chart below gives you an idea of how mortgage rates impact your monthly payment when you buy a home. Imagine being able to make a payment between $2,500 and $2,600 work for your budget (principal and interest only). The green part in the chart shows payments in that range or lower based on varying mortgage rates.

As you can see, even a small shift in rates can impact the loan amount you can afford if you want to stay within that target budget.

When working with Wenzel Select Properties, homebuyers can take advantage of our extensive network of lending partners and mortgage specialists who can offer competitive rates and financing solutions. By leveraging our relationships with trusted lenders, homebuyers can access exclusive mortgage products, negotiate favorable terms, and secure pre-approval for financing, giving them a competitive edge in today’s housing market.

Our realtors are committed to providing ongoing support and guidance to homebuyers throughout the mortgage application and approval process. From completing paperwork and gathering documentation to understanding loan terms and closing costs, our team is dedicated to demystifying the mortgage process and ensuring a smooth and seamless experience for our clients.

Staying informed and proactive is the key to keeping track of mortgage rate trends and securing the best possible financing options for your dream home. By leveraging reliable sources of financial news, online tools, and the expertise of a trusted realtor at Wenzel Select Properties, homebuyers can navigate the complexities of the mortgage market with confidence and clarity. Whether you’re a first-time homebuyer or a seasoned investor, our team is here to guide you every step of the way and help you achieve your homeownership goals.

Expert Downers Grove Real Estate Assistance

At Wenzel Select Properties, our expert Downers Grove real estate team is here to assist you with all the aspects of buying a home. We will guide you with the types of financing available, mortgages, types of homes (single-family, condo, townhome), location, price, home inspection, taxes, and much more! Our real estate agents excel at providing our clients with personalized support throughout the entire real estate experience.

If you are ready to sit down with an expert Downers Grove real estate agent, contact Wenzel Select Properties today at (630) 430-4790.